The Opportunity for Travel Apps on Mobile

Pop quiz! Name a major travel site or hotel chain that does not have its own mobile app in both of the major app stores. If you’re struggling, it’s because the travel industry already recognized that mobile devices and travelers are a match made in heaven, and has gone mobile fast. 2015 is shaping up to be a banner year for travel apps; travel-focused research firm PhoCusWright estimates mobile will account for one quarter of all US online travel sales this year, driving over $40 billion dollars in revenue, with much of that revenue coming in the peak travel booking season between July and August.

In the race for a cut of the ballooning mobile travel industry, established online travel sites have found stiff competition for their mobile apps from new, mobile-savvy tools and services such as Airbnb, Hotel Tonight and Uber. Getting consumers to install travel apps is the easy part: CWT Travel Management Institute reports that even frequent travelers only use two thirds of the travel apps they download, leaving the rest to languish unused on their devices.

To be successful, travel apps must focus their advertising dollars on active users – travelers who will not only download their app, but also complete registration and repeatedly make reservations. In our recent Mobile App Engagement Index (free download here), we measured over 22.5 million app installs and 550 million post-install events to get a better understanding of post-install engagement, including behavior in travel apps.

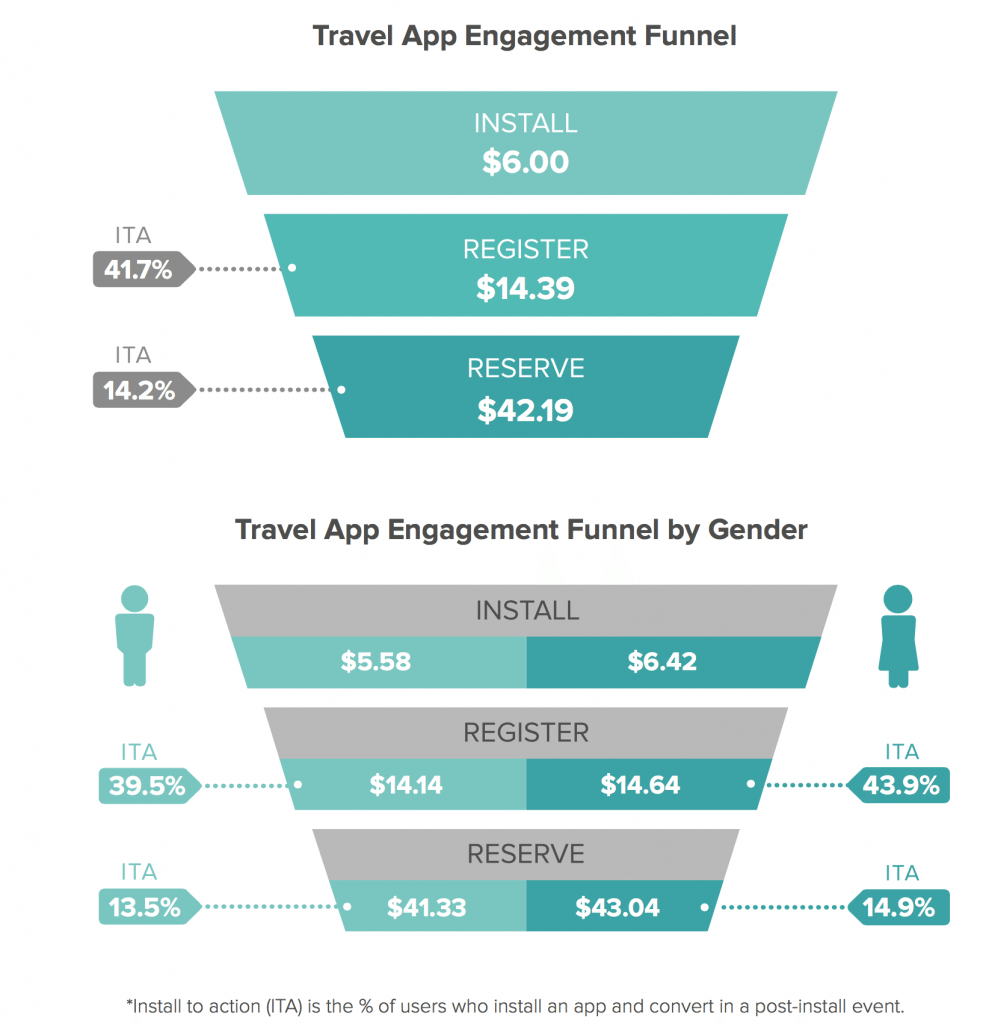

The average Cost per Install for a travel app is $6, across platforms and user demographics. Notably, the cost is lower for men ($5.58) than it is for women ($6.42). Should travel apps then focus solely on men? On the contrary: The cost of the download does not always matter. Rather, it is the actions the user takes within an app that determines the value of the user.

Women are the primary travel purchasers in most families; our Index shows women are more likely than men to register and make a reservation in travel apps. However, women registering and making bookings in larger numbers does not always make up for the higher cost of the initial download, especially when the average Cost per Reservation for men is still $1.71 less than it is for women.

This imbalance presents an opportunity for travel apps: If the Cost per Install of a quality female user can be decreased, then the higher Install to Action rates from female users will lead to increased profits from the app. This level of micro-level is exactly what Liftoff excels at. We create consumer profiles based on dozens of variables, such as age, gender, time of day, other apps installed on the consumer’s phone, past behavior interacting with ads, and more then do lookalike targeting to find the consumers that most closely match the campaign goals.

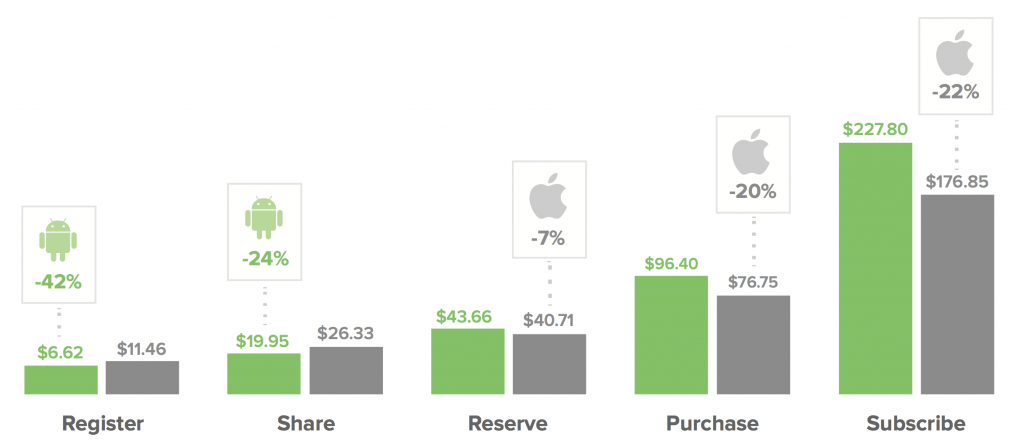

For example, travel apps will often target Android users because the cost per install is less than on iOS. However, on average, it costs 20% less on iOS to acquire users that will book a reservation, so other factors not withstanding, a smart campaign will optimize toward iOS users.

For example, travel apps will often target Android users because the cost per install is less than on iOS. However, on average, it costs 20% less on iOS to acquire users that will book a reservation, so other factors not withstanding, a smart campaign will optimize toward iOS users.

This is only a small example of lookalike targeting. With Travel being one of the most highly competitive categories on mobile, travel companies need to be savvy with where and how they spend their mobile advertising dollars.