2018 Mobile Shopping Apps Report Analysis: Engagement by Gender

Liftoff’s recent Mobile Shopping Apps Report examines the latest user acquisition trends and benchmarks to assist e-commerce marketers. Today we dive into mobile shopping app engagement by gender. Who should you market to – men or women?

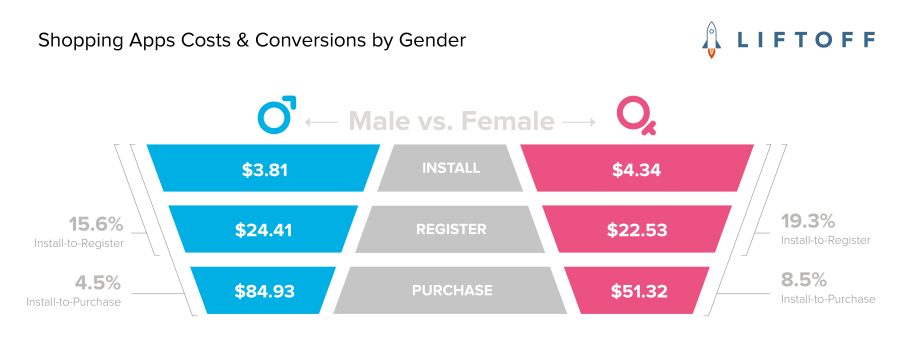

Though men are more likely to be early adopters of new technologies than women, our data suggests mobile shopping is an area where women more readily embrace innovation. At $84.93, the cost to acquire a purchasing male user is 65.5% more than that of their female counterparts.

With an install-to-purchase rate of 8.5% – nearly double that of males – females are an even better deal due to being more active and likely to make a purchase. Research suggests women are more advanced in mobile shopping and eager to use marketplaces such as Amazon. Add to the equation that females are often managing a sizeable budget (family and household budgets or significant personal wealth—or both) and it’s clear that competition for female shoppers will ramp up ahead.

It’s possible that female acceptance of mobile shopping apps can also be attributed to the rise of mobile-first brands like Glossier or Everlane, which tend to target women via platforms like Instagram. As these brands continue to successfully target women with mobile-first strategies, this valuable demographic is growing more accustomed to shopping on mobile in general: the cost to acquire a purchasing female user has decreased 4.8% from last year.

Should you capitalize on women’s growing interest in mobile shopping apps with approaches that cater to females in an increasingly competitive market? Or should you steer clear of the competition through app experiences and campaigns that target males earlier in the funnel, appealing to their desire to research products before buying? With this untapped opportunity, marketers can create new strategies to convert men and mimic the success of female-centric brands.

Both approaches have their merits. No matter what you choose, leverage a data-fueled strategy to get users to your mobile shopping app — and ensure they engage often. Download the report now to drive active shoppers to your mobile app, no matter who you target.

The 2018 Mobile Shopping Apps Report arms mobile shopping app marketers to know when and how to market their app most effectively. It draws from Liftoff internal data from April 2017 through April 2018, spanning 58.1 billion ad impressions across 10.2 million app installs, and 1.8 million first registrations and purchases.