Korean App Marketer Confidence Remains Stable, Survey Finds

43% of Korean app marketers plan to increase spending next year

At 99,720 square kilometers, Korea is 9,761% smaller than the U.S. (9,833,517 square kilometers). And yet, despite the country’s small size, Korea is home to nearly 10,000 app publishers on Google Play alone, headlined by giants such as Nexon, NCSoft, and Netmarble.

The market has peculiarities that distinguish it from the global app market, including a higher-than-average focus on mobile games — 24% of the South Korean app market is constituted of games, compared to just 14% in the global market. As part of a more extensive survey gauging market sentiment, we surveyed nearly 70 mobile app marketing professionals based in Korea to get a sense of where the market stands today, how it fared in 2022, and where the market could be in the future.

In this article, we compare our Korean respondent data with answers from marketers outside Korea to get a clearer picture of how the Korean market stacks up.

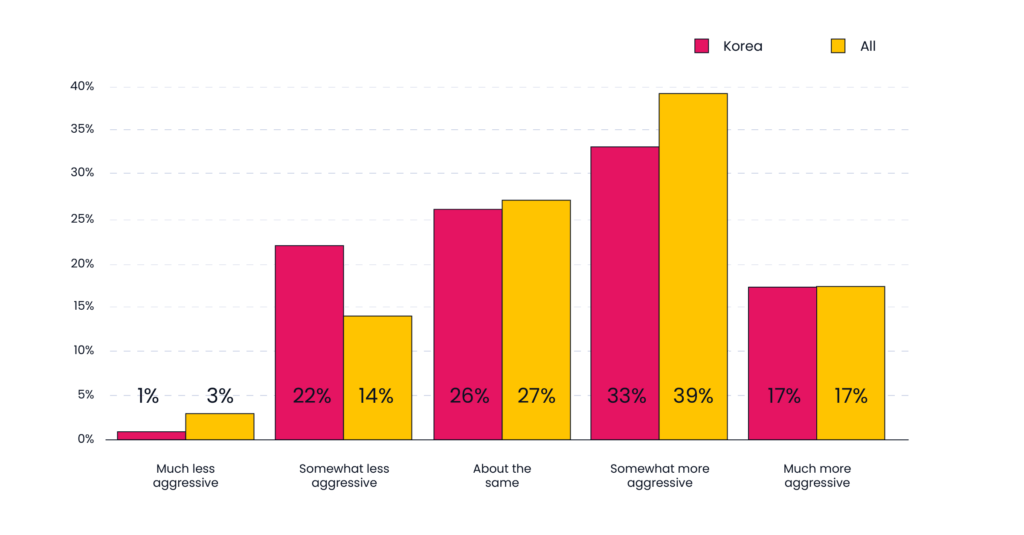

Korean app marketers’ KPIs were more aggressive

Half of Korean respondents say that their KPI goals were somewhat or much more aggressive compared to the previous year, which is consistent with the 54% global rate. Where Korea breaks away from the pack are among respondents outside of Korea who report that their KPI targets were somewhat less aggressive — Korean marketers have 22% somewhat less aggressive KPIs versus 14% outside of Korea.

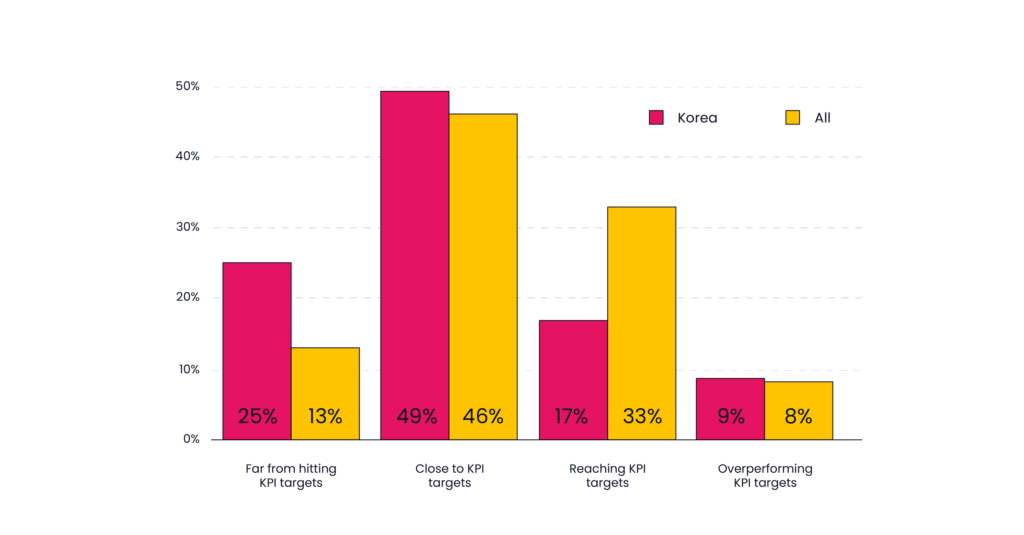

The result of that more aggressive posture is that Korean marketers fall short of KPIs more frequently than other marketers. Seventy-four percent of Korean marketers fail to meet their targets, unlike 59% of the total marketers surveyed. Though, 49% of Korean app marketers say they were close to hitting their goals.

One possible reason Korean app marketers did not hit their KPIs is that 41% saw their budgets shrink in 2022 (compared to 37% of non-Korean marketers). Meanwhile, 33% report that their budgets grew somewhat or significantly, and 26% worked with the same budgets in 2022 as in 2021.

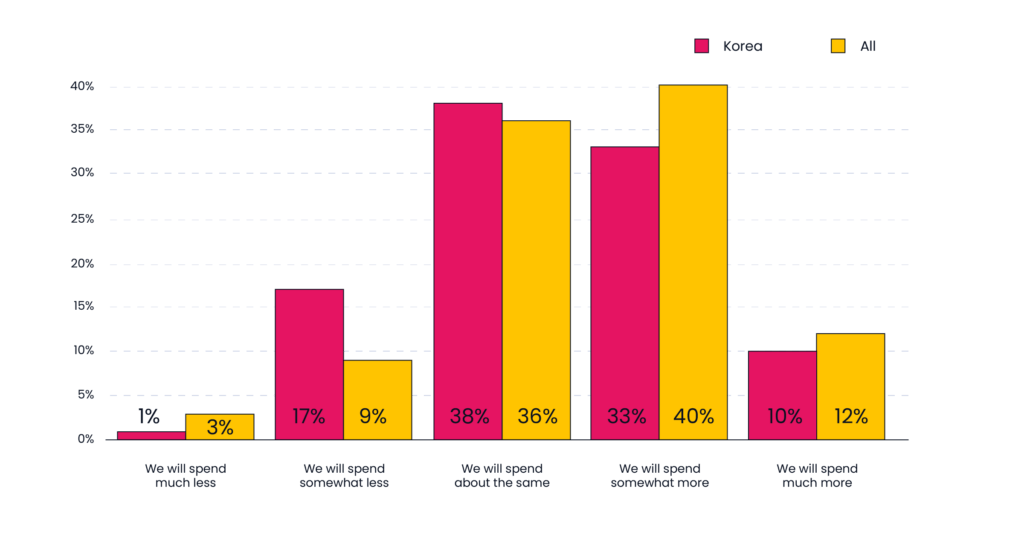

Korean app marketers plan to spend more in 2023

Nearly half (43%) of Korean app marketers expect to spend more on mobile ads in 2023 than they did in 2022 — not far from what non-Korean respondents say at 52%. Overall, Korean app marketers appear prepared to reinvest in the market, and an additional 38% of Korean app professionals expect their spending to stay about the same. Only 18% of survey respondents from Korea expect to spend less in 2023 than in 2022, compared to 12% of non-Korean respondents.

That anticipated increase in spending may be related to a perceived uptick in ongoing marketing challenges. Forty-two percent of Korean app marketers say they expect a somewhat worse market in 2023, with a notably small 7% anticipating a much worse market. Marketers’ disposition outside Korea is sunnier, with 37% saying they believe the market will be better in the next 12 months.

Despite some shrinking budgets in 2022, Korean app marketers are positioning themselves to continue growing their spending. With most marketers planning to invest as much or more than they did in 2022, 2023 should see the market gain ground.

Download our 2022 App Marketer Survey for a comprehensive outlook on the mobile marketing space, straight from app marketers on the front line.